Planning a wedding can be stressful, but setting a budget doesn't have to be. Creating a wedding budget will help you avoid wasting money or starting married life in debt. It will also affect every decision and purchase you make, so it's important to be realistic about what you can afford.

The first step is to figure out who's contributing financially. This might be just you and your fiancé, or perhaps your parents or other family members want to chip in. It's important to have respectful conversations about money and be okay with hearing no. Once you have an idea of how much financial assistance you'll receive, focus on your own contribution. How much can you and your fiancé realistically and comfortably afford, given your expenses and income?

The next step is to estimate your guest count. The cost of a wedding is largely based on the number of guests, as this will determine the size of the venue and the amount of food and alcohol you'll need to provide. Being strategic about your guest list is a great way to cut down on costs.

Now it's time to choose your non-negotiables. Discuss with your fiancé what your top priorities are and budget for those first. This might include the venue, catering, entertainment, attire, flowers, or photography.

Don't forget to consider hidden costs, such as setup and breakdown fees, vendor tips, and service fees and taxes. It's also a good idea to include an extras fund in your budget for any unexpected expenses.

Finally, be mindful of how you pay for your wedding. Try to avoid taking on debt or using credit cards, and instead, save up beforehand and spend within your means.

Happy planning!

| Characteristics | Values |

|---|---|

| Savings | All money currently in the bank, invested, or in physical cash form |

| Future savings | Money that can be saved monthly before the wedding |

| Wedding size | The number of guests will determine the size of the venue and how much food and alcohol is needed |

| Wedding type | Local or destination wedding |

| Traditions | Whether to include or leave out certain wedding traditions |

| Expenses | Rental fees for tables and chairs, wedding favours, bridal party gifts, bachelor/bachelorette party, photographer/videographer, music and entertainment, wedding invitations/stationery, and attire |

| Spending limit | The amount of money that can be spent on the wedding |

| Budget percentages | Divide the budget into percentages for each category of spending |

| Payment sources | Who will be contributing financially to the wedding |

What You'll Learn

Tally up your savings and any family contributions

Before you start planning your wedding, it's important to know how much you have to spend. This means tallying up your savings, as well as any contributions from family and friends.

Your Savings

First, look at your current savings. This includes money in the bank, investments, cash, and any stocks and bonds. This will likely be the biggest contribution to your wedding budget, so it's important to know this number.

Next, consider your income. How much can you and your partner realistically and comfortably afford to put towards the wedding? Based on your monthly income, how much can you save between now and the wedding? It's important to only spend what you can afford so you don't start your married life in debt.

Family and Friends' Contributions

It's common for family and friends to want to contribute to your wedding. To figure out your total budget, you'll need to know how much they are willing and able to give.

Money conversations can be awkward, but it's important to be respectful and approach these conversations in a sensitive way. Be prepared to hear "no" or "I can't afford to contribute". You don't want to put anyone in a difficult financial situation, so be mindful of their circumstances.

Traditionally, the bride's family paid for most of the wedding. However, these days, it's more common for the couple to pay for about half of the costs, especially if they are older and more financially established.

Putting it All Together

Once you know how much you and your partner can contribute, as well as how much help you'll receive from others, you can calculate your total budget. This will be the amount you have to work with when planning your dream wedding.

It's a good idea to leave some room in your budget for unexpected expenses. Things might come up that you didn't plan for, so having a buffer will help you stay within your budget and avoid financial stress.

Now that you know your budget, it's time to start planning! Pick your top priorities and allocate your funds accordingly. Remember to be realistic and only spend what you can afford.

Addressing Our Special Day: Share Your Joy and Addresses for Our Wedding

You may want to see also

Maintain a detailed spreadsheet

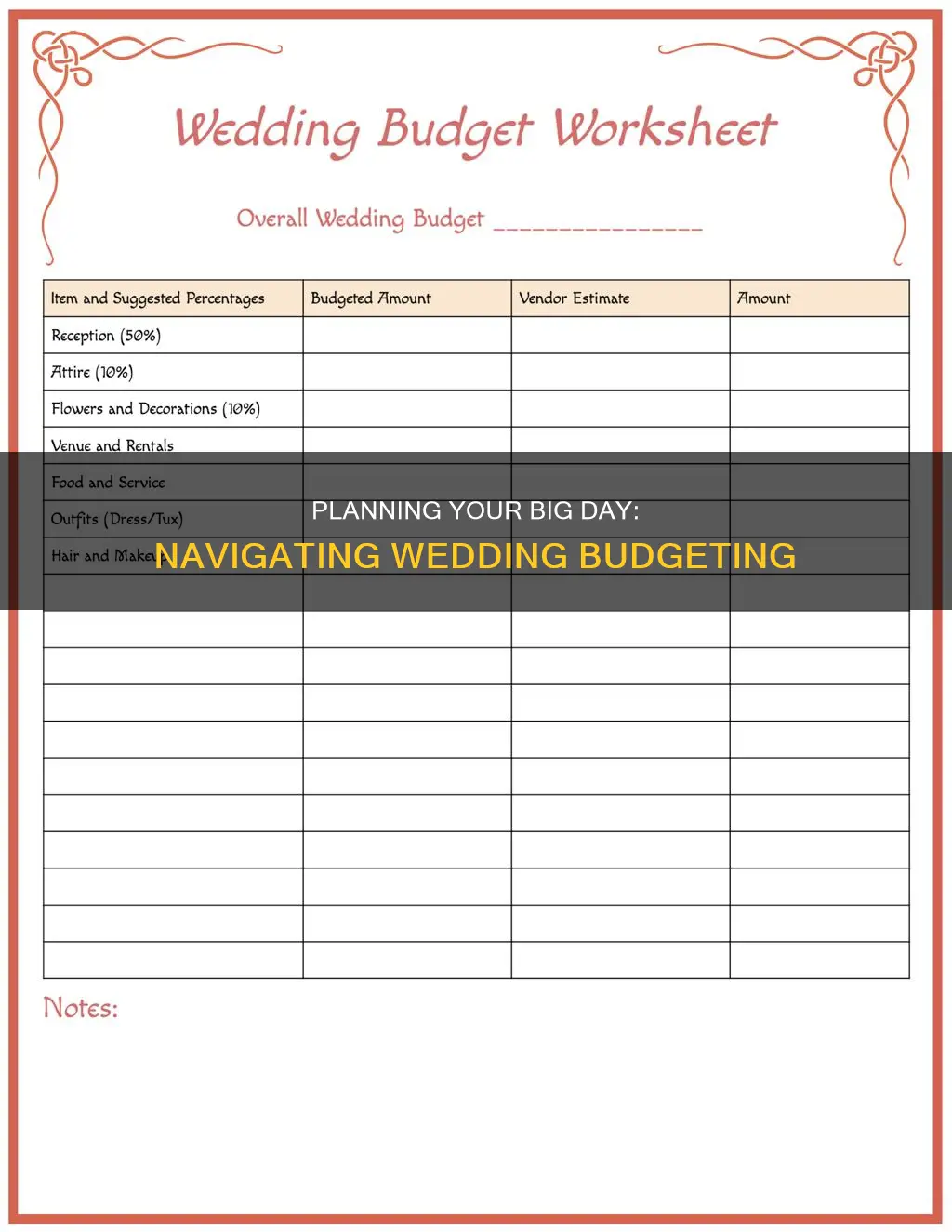

Maintaining a detailed spreadsheet is a crucial step in wedding budget planning. It allows you to track expenses, payments made, balances due, and prepare for unexpected costs. Here are some tips to help you maintain a comprehensive spreadsheet:

- Create a spreadsheet with three expense columns: Estimated, Modified, and Actual. The "Estimated" column will be driven by researching costs in your area, while the "Modified" column will contain proposals from the vendors you choose. The "Actual" column will be for the final amount you pay to each vendor.

- Adjust your estimates as you receive vendor cost estimates. Start with the venue, as it is the biggest expense and a major factor in determining guest count.

- Verify whether tax is included in the vendor's estimate. If not, calculate the tax amount yourself using state and local tax rates, and adjust the proposal accordingly.

- Include a column for estimated tips. Write "included" if gratuity is already factored into the vendor's price. For example, caterers usually include a 15% to 20% gratuity in their total, which you pay in advance.

- Add a line item called "Extras" and allocate around 15% of your total budget to this category. This will cover incidental costs that may arise throughout the planning process, such as invitation postage, parking valets, corkage fees, and plating fees.

- Be mindful of potential hidden costs and unexpected expenses. For instance, vendor transportation, setup and breakdown fees, signature drinks, digital photo access, assembly fees for wedding invitations, and service fees and taxes.

- Consider using a free budgeting app or a separate wedding checking account to easily track your wedding budget and expenses.

- Update your spreadsheet regularly and ensure that it is shared with your partner, and anyone else contributing financially, to keep everyone informed and on the same page.

By maintaining a detailed spreadsheet, you can effectively track your wedding budget, make adjustments as needed, and ensure that you stay within your financial means.

The Art of Japanese Wedding Envelope Etiquette

You may want to see also

Prepare for unexpected costs

Preparing for unexpected costs is a crucial aspect of wedding budget planning. Here are some detailed instructions to help you brace for unforeseen expenses:

- Set aside an emergency fund: Aim to allocate around 5% to 15% of your total wedding budget for unexpected costs. This buffer will provide financial flexibility and peace of mind when dealing with surprises.

- Understand hidden costs: Many wedding expenses are not immediately apparent. Research common hidden costs, such as cake-cutting fees, postage for invitations, event liability insurance, additional staffing fees, and guest transportation.

- Anticipate vendor travel fees: If your wedding vendors have to travel a significant distance, they may charge travel fees to cover their time and fuel expenses. Opt for vendors based near your wedding venue, and always inquire about travel fees upfront.

- Choose an all-inclusive venue: Opting for a venue that includes catering and other services can help streamline your budget and reduce unexpected costs. Alternatively, if you rent a space, you'll need to account for tables, chairs, silverware, glassware, and more.

- Read contracts carefully: Carefully scrutinize contracts from venues and vendors to identify any additional fees or requirements, such as wedding insurance or specific caterers or florists. Understanding these details upfront can help you avoid surprises.

- Plan for overtime charges: Your band, DJ, photographer, and videographer are typically booked for a set amount of time. If your wedding runs longer than expected, they may charge overtime fees, typically starting at $250 per hour. Factor in additional time for getting ready and taking photos to avoid unexpected charges.

- Budget for trials and extras: Trials for hair, makeup, and beauty treatments can add up. Each trial typically costs around €50 or more. Additionally, don't forget to budget for pre-wedding beauty treatments, such as facials, skincare, spray tans, teeth whitening, and waxing.

- Consider transportation for guests: Providing transportation for guests between ceremony and reception venues, or to and from their accommodation, can cost thousands of dollars. If you're considering this option, be sure to include it in your budget.

- Factor in vendor meals: Your vendors, including the band, DJ, photographer, and videographer, will need to be fed. Vendor meals typically range from $30 to $90 per person, and it's a contractual requirement in many cases.

To Return or Not to Return: Navigating the Wedding RSVP Address Conundrum

You may want to see also

Be mindful of how you use credit cards

When it comes to wedding expenses, credit cards can be a double-edged sword. Used wisely, they can help you save money and earn rewards. But if you're not careful, you could end up in debt. Here are some tips to help you use credit cards mindfully when planning your wedding:

- Be cautious and disciplined: Credit cards can be beneficial if used with caution and self-discipline. Understand the common types of reward structures, such as sign-on bonuses, flat-rate cash back, and rotating categories, to make informed choices.

- Match your spending habits: Choose a credit card that aligns with your regular spending habits rather than changing your patterns to fit a specific card. Consider your spending habits and select a card that offers rewards in those categories.

- Annual fees: Some premium credit cards offer lucrative perks but come with steep annual fees. Evaluate whether the benefits outweigh the cost. If you don't already live a high-end lifestyle, a card with a high annual fee may not be the best choice.

- Pay off balances promptly: As a general rule, avoid charging expenses to your credit card unless you can pay them off within 30 days. Paying off your balance promptly helps you avoid accruing interest and keeps your financial burden manageable.

- Take advantage of rewards: If you have the money to pay off your credit card charges, using a credit card for wedding expenses can be advantageous. You can earn rewards such as cash back, airline miles, or loyalty points, which can be useful for your honeymoon or future travels.

- 0% intro APR cards: If you need to finance your wedding expenses over time, consider a credit card with a 0% introductory APR. These cards allow you to make interest-free payments for a promotional period, giving you more flexibility to pay off your wedding costs.

- Track your spending: It's crucial to keep a close eye on your wedding expenses. Open a separate savings or checking account specifically for wedding expenses, and consider using a budget app to stay on top of your spending.

- Be mindful of interest rates: While credit cards can provide benefits, they can also come with high-interest rates. Be cautious of carrying a balance, as the interest charges can quickly outweigh any rewards you earn.

- Understand hidden costs: Be aware of hidden costs associated with credit cards, such as annual fees, balance transfer fees, foreign transaction fees, and late payment penalties. Read the fine print to ensure you understand all the charges involved.

- Compare cards and perks: Compare different credit cards and their perks to find the one that best suits your needs. Look for cards with rewards programs or sign-up bonuses that align with your wedding expenses.

- Set a realistic budget: Determine your overall wedding budget and allocate funds accordingly. Don't rely solely on credit cards to fund your wedding. Have a clear plan for how you will pay off any charges you make.

Composing the Perfect Prelude: A Guide to Crafting Wedding Prelude Music

You may want to see also

Find ways to save

Now that you have a clear picture of the costs involved in your wedding, it's time to explore ways to save money without compromising on the overall vision and style of your special day. Here are some strategies to reduce expenses and stay within your budget:

- Choose an off-peak day and time: Opting for a weekday wedding, particularly Friday or Sunday, can result in significant savings on venue rates. Additionally, consider hosting your wedding during the shoulder seasons, such as late winter or early spring, when rates are typically lower.

- Reduce the guest list: One of the most effective ways to lower costs is to trim your guest list. With a smaller guest count, you'll spend less on catering, invitations, venue size, and rentals.

- Select an all-in-one venue: Choosing a venue that can accommodate both your ceremony and reception will not only save you money on rental fees but also eliminate the need for guest transportation between locations.

- Skip the open bar: Instead of offering a full bar, consider serving only beer, wine, and a signature cocktail or two. Opting for affordable mid-range drinks and skipping top-shelf liquor can help you save on alcohol costs without compromising on your guests' enjoyment.

- Limit transportation costs: If possible, choose a venue that is within walking distance of the ceremony location to eliminate the need for guest and wedding party transportation. This can result in savings of up to $4,000.

- Opt for a plated meal: While a buffet might seem like a more affordable option, caterers often require more food to ensure the buffet looks plentiful throughout the event. A plated meal allows for more precise calculations, resulting in less waste and potential cost savings.

- Be strategic with flowers: Flowers can be a significant expense. Consider using ceremony florals for double duty at the reception, such as repurposing bridesmaids' bouquets for reception tables. Additionally, opt for in-season and local flowers to save on transport costs, or choose greenery over flowers for a more affordable and on-trend option.

- Simplify stationery: Wedding invitations and stationery can quickly add up, especially with multiple enclosures and specialised printing techniques. Opt for digital printing and RSVP postcards or online RSVPs to save on postage costs.

- Shop early for attire: Start shopping for your wedding attire at least eight months in advance to avoid rush fees and last-minute alteration costs. Sample sales and trunk shows are also excellent opportunities to find your dream dress at a fraction of the cost.

- Limit videography services: While it might seem necessary to have two videographers, a solo shooter can often capture your special day just as effectively. Discuss this option with your videographer and consider having a solid timeline to ensure all key moments are captured.

- Bundle services: Inquire about package deals and service bundles, especially for photography and videography. Many vendors offer discounts when booking multiple services, helping you save money without sacrificing quality.

- Embrace vintage and borrowed items: Shop your own homes and reach out to family and friends for décor items, accessories, and attire. Borrowing vintage items or family heirlooms can add a unique and sentimental touch to your wedding while saving you money.

The Etiquette of Wedding Thank-Yous: Handwritten or Typed?

You may want to see also