Planning a wedding can be an expensive and stressful endeavour. The average cost of a wedding in the US is around $30,000, but this can vary widely depending on location, guest count and other factors. While some couples opt for the traditional route of having family members contribute, others foot the bill themselves. Here are some tips to help you afford your big day:

- Create a dedicated wedding fund and set a realistic budget.

- Evaluate your current savings and how much you can spend.

- Use credit cards with introductory 0% APR offers, but be mindful of interest rates and pay off the balance promptly.

- Consider taking out a personal loan, but be aware of the interest rates and repayment terms.

- Ask your parents or loved ones for financial help.

- Cut back on monthly expenses and unnecessary spending.

- Sell items online or take on freelance work to boost your income.

- Choose a less expensive reception style, such as a buffet instead of a plated meal.

- Opt for a DJ instead of a live band.

Savings

Saving for a wedding can be challenging, but with careful planning and budgeting, it is possible to achieve your dream celebration. Here are some strategies for saving up for a big wedding:

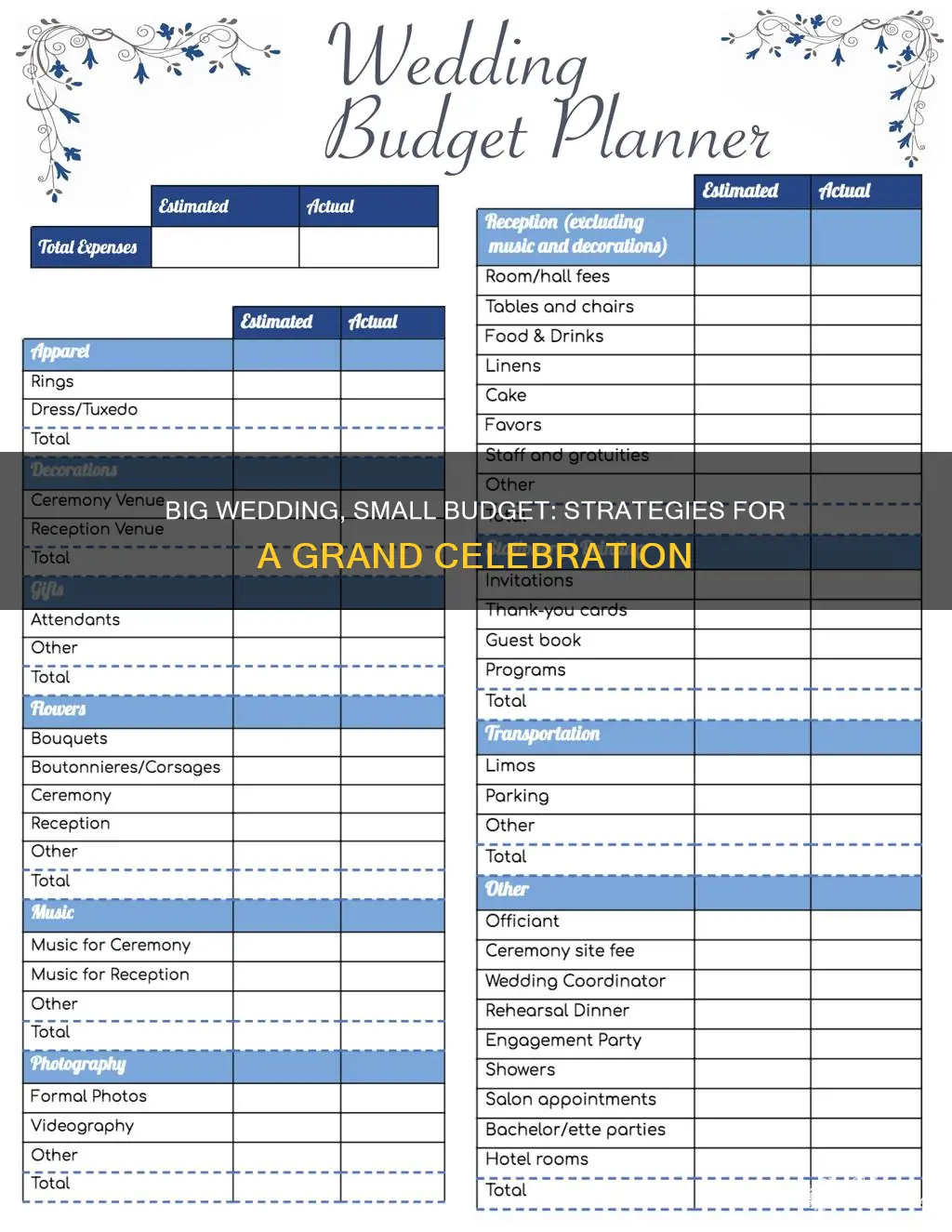

Define Your Budget and Priorities

The first step is to define your wedding budget. Be realistic about how much you can afford to spend and what your priorities are. Create a detailed list of all the expected costs, including the venue, catering, flowers, attire, entertainment, and any other expenses. Prioritize the aspects that are most important to you and allocate your funds accordingly.

Start Saving Early

The sooner you start saving, the better. Calculate how much you need to set aside each month to reach your target budget. Consider using a dedicated wedding savings account or a high-interest savings account to maximize your earnings. If you have a longer engagement, you can take advantage of compound interest to grow your savings faster.

Cut Back on Expenses

Evaluate your monthly expenses and identify areas where you can cut back. This could include reducing dining out, vacations, subscription services, or any non-essential costs. Negotiate with service providers to get better deals, cancel unnecessary subscriptions, and shop around for lower-cost alternatives. Every dollar saved brings you closer to your dream wedding.

Increase Income

Consider taking on part-time work or picking up freelance projects to boost your income. Use your skills to offer services online or find local opportunities. This extra income can make a significant difference in your wedding savings.

Make Sacrifices

If a big wedding is your top priority, you may need to make some sacrifices. This could include postponing the wedding to give yourself more time to save, moving in with family to save on rent, or even selling a car if it's feasible. These sacrifices can free up a significant amount of money.

Use Credit Cards Wisely

Credit cards can be a convenient way to manage wedding expenses, but they should be used wisely. Aim to pay off your balances in full and on time to avoid interest and penalties. Look for credit cards with rewards or cashback that can help offset some of your costs. However, be cautious not to spend beyond your means, as starting your married life in debt can be challenging.

Get Creative

Think outside the box to generate extra cash. Consider selling unwanted items online, starting a side hustle, or offering freelance services. Every dollar counts when it comes to saving for your dream wedding.

Trim the Guest List

One of the most effective ways to reduce costs is to trim your guest list. A smaller guest list means lower catering costs, fewer invitations, and a more intimate celebration. It's a difficult decision but can have a significant impact on your budget.

Choose Affordable Alternatives

Opt for affordable alternatives to traditional wedding elements. For example, choose a weekday or off-season wedding date, a less popular venue, or a cocktail-style reception instead of a sit-down dinner. These choices can help you save significantly without sacrificing the joy of your special day.

Seek Professional Help

Hiring a wedding planner may seem counterintuitive, but planners have industry connections and expertise to help you secure the best deals. They can also keep you on track with your budget and prevent overspending.

Remember, saving for a big wedding requires discipline, creativity, and a clear plan. By following these strategies and adapting them to your unique circumstances, you can make your dream wedding a reality without breaking the bank.

My Big Fat American Gypsy Wedding": Scripted or Real

You may want to see also

Help from loved ones

While there is no one-size-fits-all approach to financing a wedding, one common way to pay for a big wedding is to get help from loved ones. This can include financial contributions from family members and friends.

Asking for Financial Help

Asking for financial help from loved ones can be a tricky conversation, but it's important to be clear about your expectations to avoid stress later on. It's a good idea to have this conversation in person and to be respectful and honest about your plans and budget. It's also important to remember that if your parents contribute, they may want to have a say in decisions like the guest list, venue, and more.

Creating a Realistic Budget

Before asking for help, it's crucial to have a realistic idea of your budget and how much you need to cover. This means estimating the total cost of the wedding and breaking it down into smaller, more manageable amounts that you can set aside each month. This will give you a clear picture of how much help you need and will show your loved ones that you are serious about planning and saving for the wedding.

Saving Strategies

To make saving for your big day more manageable, consider creating a dedicated wedding fund. This will allow you to stash away funds specifically for your wedding and make it easier to reach your financial goals. You can also look for ways to cut back on monthly expenses, such as gym memberships or subscription services, to free up extra money for your wedding fund.

Other Ways to Contribute

If your loved ones are unable to contribute financially, they may be able to help in other ways. For example, they could offer to help with wedding-related projects or provide their skills or services for free or at a discounted rate.

Remember, it's important to be mindful of your loved ones' feelings and to approach these conversations with gratitude and flexibility. By involving your loved ones in your wedding plans and being clear about your financial needs, you can make planning your big day a collaborative and memorable experience for everyone involved.

Big Fat Greek Wedding 3: Where to Watch the Heartwarming Finale

You may want to see also

Credit cards

Choose the right card

There are many different types of credit cards, so it's important to pick one that fits your needs and spending habits. Consider what type of rewards you want (cash back, hotel points, frequent flyer miles, etc.) and whether you want a card with a competitive welcome offer, a lengthy 0% intro APR, or travel perks and protections. Also, make sure to choose a card with categories that align with your spending habits. For example, if you're booking a hotel for your wedding venue, select a card with a high earning rate on travel purchases.

Take advantage of sign-up bonuses

Many credit cards offer generous sign-up bonuses, such as a certain number of points or miles after you spend a certain amount of money within the first few months. These bonuses can be very valuable, especially if you're planning a honeymoon or a destination wedding.

Be strategic with multiple cards

If you're getting married, consider signing up for multiple credit cards with different benefits. For example, one card might offer great rewards on travel, while another might give you cash back on all your purchases. Just keep in mind that opening multiple cards can affect your credit score.

Pay off your balance

It's important to have a plan to pay off your credit card balance before the 0% intro APR period ends. Credit cards tend to have high-interest rates, so you could easily find yourself in debt if you're not careful.

Be mindful of fees

Rewards cards often come with steep annual fees, and some wedding vendors may charge a processing fee for credit card payments. Make sure to factor these fees into your decision.

Protect your purchases

When paying with a credit card, you have additional recourse if something goes wrong. The Fair Credit Billing Act allows you to dispute charges for products or services that weren't "delivered as agreed."

Don't overspend

Combine with other savings strategies

Using a credit card for your wedding should be part of a larger financial strategy. Consider using a combination of cash, savings, and credit to pay for your big day.

Vase Volume: Crafting the Perfect Wedding Centerpiece

You may want to see also

Wedding loans

There are several lenders that offer wedding loans, including:

- Achieve: Best for wedding loans with co-applicants

- Discover: Best for wedding loans for good credit

- LightStream: Best for wedding loans with no fees

- Prosper: Best for wedding loans for fair credit

- SoFi: Best for large wedding loans

- Upstart: Best for wedding loans for bad credit

Before taking out a wedding loan, it is important to consider the pros and cons. Wedding loans can help you build credit and may offer lower interest rates than credit cards. They also provide a lump sum, which can help you stick to your budget, and have fixed monthly payments. On the other hand, if you have fair or bad credit, you may get stuck with high-interest rates that are difficult to pay off. Starting your marriage with debt from your wedding day may not be wise, and late or missed payments can negatively impact your credit score.

It is also worth noting that wedding loans may not be the cheapest way to pay for your wedding, so it is important to compare them with other financing methods, such as credit cards, to choose the most affordable option for your plans.

What's a Typical Wedding Size?

You may want to see also

Retirement savings

While it's tempting to dip into your retirement savings to pay for your big day, financial experts advise against it. Not only will you have to pay penalties and taxes, but it also sets a bad precedent for the future. Instead, there are several other ways to save for or finance your wedding.

Save, Save, Save

The earlier you start saving, the better. Work out how much you can realistically put aside each month and set up a direct deposit into a dedicated wedding savings account. A high-yield savings account or a money market account could offer interest earnings, but they come with limited accessibility. You could also look into certificate of deposit rates, as the yields are particularly high right now.

Cut Back on Spending

Take a look at your monthly expenses and see where you can cut back. This could include reducing dinners out, taking fewer vacations, or cancelling cable and replacing it with a lower-cost alternative. You could also shop at thrift stores, review your credit card bill for unused subscriptions, and cut back on non-essential monthly costs like Netflix, Amazon Prime, or Spotify.

Make Some Sacrifices

If a big wedding is your top priority, you may need to make some sacrifices to make it happen. This could include waiting a little longer to have the wedding until you have the funds, or moving in with your parents to save on rent.

Pick Up Extra Work

Consider picking up some extra work on the side or asking for a raise from your employer to help you save for your dream wedding. You could also freelance or sell items you no longer need online.

Credit Cards and Loans

While financial experts advise against going into debt to pay for your wedding, some suggest being strategic about using credit. For example, you could open a credit card with generous rewards and put all your wedding expenses on it. Just make sure you have the cash to pay it off right away. Another option is to take out a personal loan, but be cautious as these often come with high-interest rates and long repayment terms.

Ask for Help

While it's traditional for the parents of the couple to contribute to the wedding, this is not always the case. If you'd like your parents to help, have an honest conversation with them early in the planning process.

Comparison Shop

Comparison shopping is one of the best ways to save on wedding costs. Get multiple quotes from vendors and try to negotiate a better deal. You should also be aware of cancellation and refund policies, especially if you're planning a destination wedding.

Choose an Off-Peak Date and Location

The time of year and location of your wedding can also affect your budget. Holding your wedding during the off-season (mid-winter) or choosing a less popular date (Friday or Sunday) may be less expensive, as demand for vendors and venues will be lower.

Remember, it's important to start planning as early as possible, be realistic about what you can afford, and don't be afraid to make some sacrifices to have the wedding of your dreams.

Arabian Nights: The Extravagance of Arab Weddings

You may want to see also

Frequently asked questions

The average cost of a wedding in the US is around $30,000, but this varies depending on location, guest count, and other factors. In 2023, the average cost was $35,000.

It's a good idea to create a dedicated wedding fund and set a realistic budget. You could also cut back on monthly expenses, reduce little spending habits, and make bigger sacrifices, like moving in with your parents to save on rent.

It's traditional to ask your parents to chip in, but every family is different. Set aside time to have the conversation in person, and be clear about your budget and how much you need to cover.

You could take out a wedding loan, but be aware of the interest rates and long-term repayment plans. You could also use a credit card with an introductory 0% APR, but make sure you can pay off the balance before the promotional period ends.