Weddings are expensive, and it's no surprise that people want to write off some of the costs as business expenses. However, this is a tricky area, and it's important to understand the rules and regulations to avoid getting into trouble with the tax authorities. In general, weddings are not considered business expenses, even if most of the guests are clients or employees. To be considered a business expense, entertainment must be ordinary and necessary and must have a clear business element or purpose. While some tax deductions might be possible in certain circumstances, it's essential to carefully review the guidelines and consult with an accountant or tax advisor.

What You'll Learn

The wedding must be a business event

If you want to deduct the costs of your wedding as a business expense, it's important to understand the criteria that define a business event. While it may be tempting to write off a portion of your wedding expenses as a business expense, particularly if you invite work colleagues or clients, it's important to note that weddings are generally considered personal expenses and don't fall under the category of "ordinary and necessary" expenses as defined by the Internal Revenue Service (IRS).

To classify your wedding as a business event for tax purposes, you must demonstrate that the primary purpose of the event was business-related. This means that the event should be directly connected to your business and serve a legitimate business function. Simply inviting business associates or clients may not be sufficient to justify the expense as a business event. The IRS scrutinizes such expenses carefully, and you may need to provide evidence of the business nature of the event.

If you're considering deducting wedding expenses as a business expense, it's essential to consult with a tax professional or an accountant. They can advise you on the specific requirements and help you assess whether your wedding can be legitimately classified as a business event. It's important to remember that attempting to write off personal expenses as business expenses without a valid reason could lead to serious legal and financial consequences.

To increase the likelihood of your wedding being considered a business event, you can incorporate specific elements that emphasize its business nature. For example, you could organize a separate business meeting or networking session before or after the wedding, specifically dedicated to discussing business matters with your guests. This would strengthen the argument that the event served a clear business purpose.

Additionally, when planning the guest list, consider focusing on inviting individuals who are directly related to your business, such as clients, business partners, or vendors. This can help demonstrate that the primary purpose of the event was to conduct business and foster business relationships. Remember to keep detailed records of the guest list and any business-related discussions or activities that took place during the event, as this documentation may be useful if the expense is ever questioned by tax authorities.

Wedding Expenses: Tax Deductible in Canada?

You may want to see also

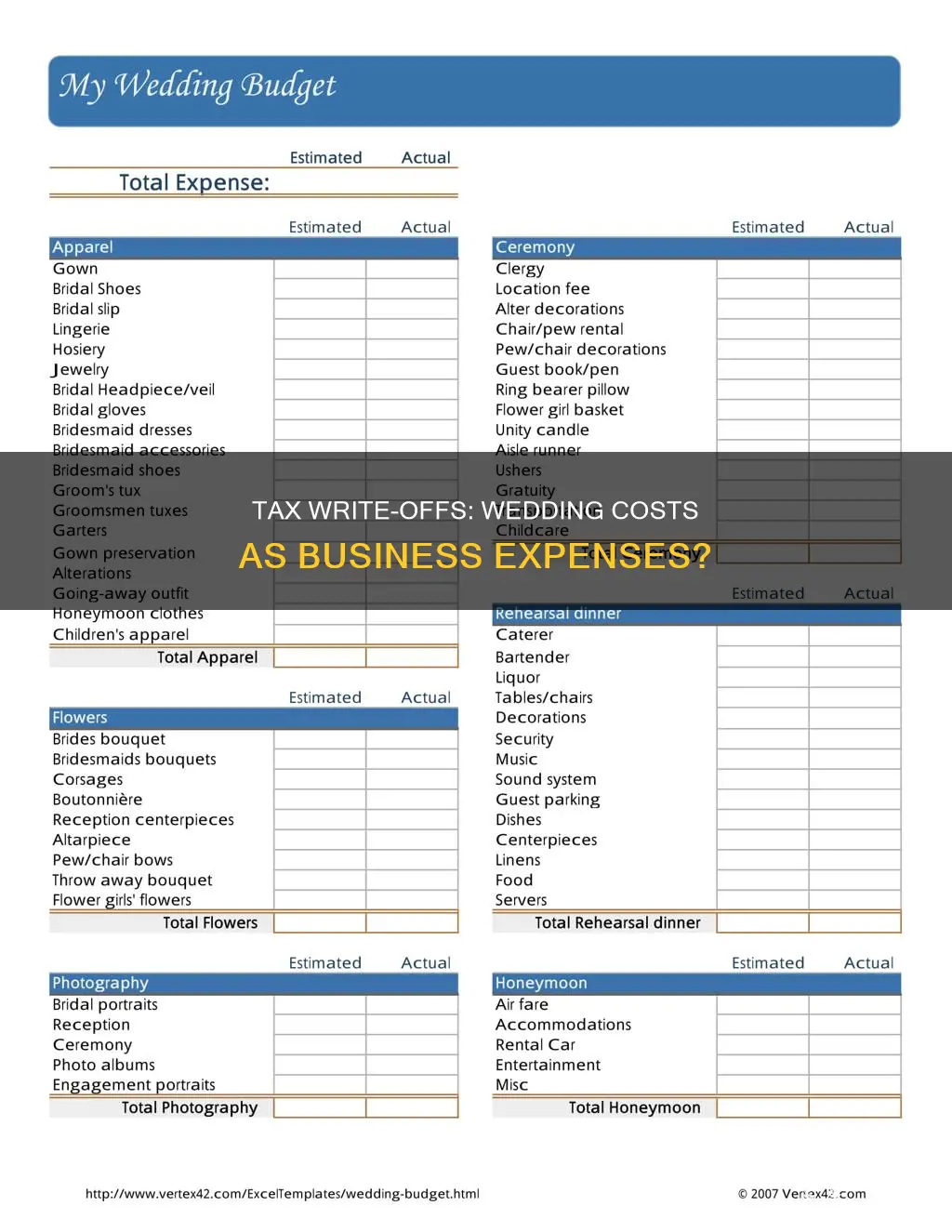

Deducting wedding costs as a business expense

Weddings are expensive, so it is unfortunate that they aren't tax-deductible. However, with careful planning, there are some ways to garner a tax deduction as you prepare to head down the aisle.

Firstly, it is important to note that the Internal Revenue Service (IRS) insists that entertainment be an "ordinary and necessary" expense to your business before you can deduct it for tax reasons. This means that the expense has to be common and accepted in your business, and you have to actively conduct business either before, after, or during the entertainment. The IRS also states that you cannot deduct entertainment expenses that are lavish or extravagant.

With that in mind, if you think you have a strong case for deducting your wedding costs as a business expense, it is a good idea to run it by your accountant or tax advisor first.

If you are having your wedding reception at a historical garden, museum, homestead, or even a state or national park, the fee you pay may be tax-deductible as a donation. Check with the site representative for more details. It is important to note that any fee paid in exchange for a service won't be deductible.

Another way to deduct wedding costs as a business expense is to donate your wedding gown and bridesmaid dresses to a non-profit organization. You can also donate flowers to a homeless shelter, women's center, or similar non-profit organization and take a tax deduction for the value of the items donated. Remember that the deductible amount may be less than the price you paid, as it is based on the condition of the donated items.

You can also make a donation to a charity on behalf of everyone at your wedding as a "thank you," which will help others while also providing you with a tax deduction. To claim a tax deduction for charitable donations, you must donate to a not-for-profit charitable organization, and you typically need to have enough tax deductions to itemize your deductions.

Finally, if you have leftover food from your wedding, you can donate it to an IRS-recognized non-profit organization that feeds others in need. The organization will provide you with a donation letter that you can use as proof of charitable contribution. Unless the food is in its original condition, it should be valued at less than the full retail price.

In conclusion, while it may be challenging to deduct wedding costs as a business expense, there are some strategies you can employ with careful planning. It is always best to consult with a tax professional to ensure you are following the correct procedures and meeting the necessary criteria.

Finding the Perfect Wedding Cake: Where to Buy?

You may want to see also

Charitable donations

While weddings are generally not considered business expenses, charitable donations made during a wedding can be deducted from your taxes. These deductions may be limited and may only be deductible for individual owners rather than the business itself. For example, if you hold your wedding at a museum, historical building, public park, or church, you may be able to deduct part of the rental fee as a charitable donation.

According to the Internal Revenue Service (IRS), a charitable payment that bears a direct relationship to the taxpayer's business and is made with a "reasonable expectation of financial return commensurate with" the amount transferred is not a charitable contribution. Instead, it may be deducted as an ordinary business expense. This means that the payment must be clearly shown to be made in the furtherance of business purposes and not a mere gift.

The IRS allows for both cash and non-cash donations, such as goods, inventory, and property, to be deducted. Cash and check donations must have proof of the donation to be deductible. Additionally, expenses for volunteering at a qualified service project or charitable event may be deducted, including gas and mileage necessary to attend the event and any supplies donated. However, it is important to note that the time spent volunteering or the time of employees volunteering cannot be deducted.

To claim a deduction for a charitable donation, the organization must be recognized by the IRS as a qualified organization. Typically, only 501(c)(3) organizations qualify, and donations to individuals or other 501(c) designated non-profits are usually not eligible for a deduction. You can verify if an organization qualifies by asking for their IRS designation letter or by using the IRS Exempt Organizations Select Check online tool.

A Couple's Prostration: Wedding Rituals and Traditions

You may want to see also

Tax write-offs

Weddings are generally not considered business expenses, even if most of the guests are clients or employees. However, there are certain situations where you may be able to claim some tax write-offs related to a wedding. Here are some things to consider:

Entertainment vs Marketing Expenses:

The Internal Revenue Service (IRS) has strict guidelines when it comes to deducting entertainment expenses. To be eligible for a tax deduction, entertainment must be considered "ordinary and necessary" to your business. This typically includes expenses that are common and accepted in your industry. Additionally, you must actively conduct business either before, during, or after the entertainment event. It's important to note that the IRS does not specifically mention weddings as deductible entertainment expenses, and lavish or extravagant expenses are not allowed.

Charitable Donations:

If your wedding is held at a museum, historical building, public park, or church, you may be able to deduct part of the rental fee as a charitable donation. Donating your wedding dress, bridesmaid dresses, and leftover food to charitable organizations can also provide tax benefits. Remember to obtain donation receipts for any items donated.

Travel and Business Expenses:

If you are attending a wedding for business purposes, such as solidifying relationships with clients, you may be able to deduct certain expenses. Travel costs, including transportation and accommodations, can be tax-deductible. However, it is important to carefully document the business purpose of your attendance and any business-related discussions that take place during the event. Keep in mind that the IRS may consider these expenses as entertainment-related, which are typically non-deductible.

Gifts and Donations:

When it comes to wedding gifts, there is a limit to how much you can deduct. Business gifts to an individual are typically limited to $25 per person, and it is important to follow the IRS guidelines for gift deductions. On the other hand, making a donation to a charity on behalf of the wedding guests can provide a tax deduction while also supporting a good cause.

In summary, while it may be challenging to deduct wedding expenses as business expenses, there are certain strategies you can employ to maximize tax write-offs. These include understanding the difference between entertainment and marketing expenses, taking advantage of charitable donation opportunities, carefully documenting travel and business-related expenses, and following the guidelines for gift deductions. It is always recommended to consult with an accountant or tax advisor to ensure you are complying with tax regulations and maximizing your deductions.

The Secret Language of Wedding Rings

You may want to see also

Business mileage

If you're a wedding vendor, you can deduct the miles you drive for business purposes from your taxes. The Internal Revenue Service (IRS) publishes a standard mileage rate each year, which is the amount of money you can deduct per mile. For example, in 2021, the standard IRS mileage rate was 56 cents per mile for business miles driven, and in 2023, it was 65.5 cents per mile.

To calculate your deduction, you can use either the simple method or the actual method. The simple method involves multiplying the number of business miles you drove for the year by the standard mileage rate. For example, if you drove 150 miles to and from a wedding venue, you would multiply 150 by the standard mileage rate to find your deduction.

The actual method allows you to deduct additional expenses, such as new tires, oil changes, gas, bridge tolls, parking fees, maintenance, repairs, insurance, and DMV registration, on a pro-rata basis. To use this method, you divide the total number of business miles by the total number of miles driven, then multiply that percentage by your expenses. For example, if 80% of your miles were for business, you could deduct 80% of the cost of new tires.

It's important to keep track of your business miles and any expenses you want to deduct. You can use a spreadsheet, an app, or your calendar to record your miles and expenses. The IRS audits these records, so it's important to be thorough and consistent.

The Legalities of Love: Understanding Wedding Registration

You may want to see also

Frequently asked questions

Weddings are generally not considered to be undertaken for business reasons, even if most of the guests are clients or employees. Unless you made a profit, you will not be able to deduct wedding costs as a business expense.

If you think you have a strong case, it is best to consult an accountant or tax advisor.

Yes, with some planning, there are ways to garner tax deductions. For example, if your wedding is held at a museum, historical building, public park, or church, you may be able to deduct part of the rental fee as a charitable donation.

You can donate your wedding gown to a non-profit organization and claim a tax deduction. The same goes for bridesmaid dresses and other decorations.

Yes, you can donate leftover food to a local community organization that provides services to those in need and get a donation receipt.