Newlyweds often face the challenge of managing debt post-wedding and honeymoon, which can significantly impact their financial future. Understanding the average debt levels and sources of financial strain can help couples make informed decisions about budgeting, saving, and managing their finances effectively. This article will explore the common financial obligations that newlyweds may encounter and provide insights into strategies for financial planning and debt management.

What You'll Learn

- Average Debt Statistics: Newlyweds often face financial challenges post-wedding, with an average debt of $25,000

- Factors Influencing Debt: Wedding expenses, honeymoon costs, and lifestyle choices contribute to varying debt levels

- Debt Management Strategies: Budgeting, financial planning, and seeking professional advice can help manage post-wedding debt

- Impact on Long-Term Finances: High debt can affect future financial goals, requiring careful planning and discipline

- Cultural and Regional Variations: Debt levels vary by culture and region, with some couples facing unique financial challenges

Average Debt Statistics: Newlyweds often face financial challenges post-wedding, with an average debt of $25,000

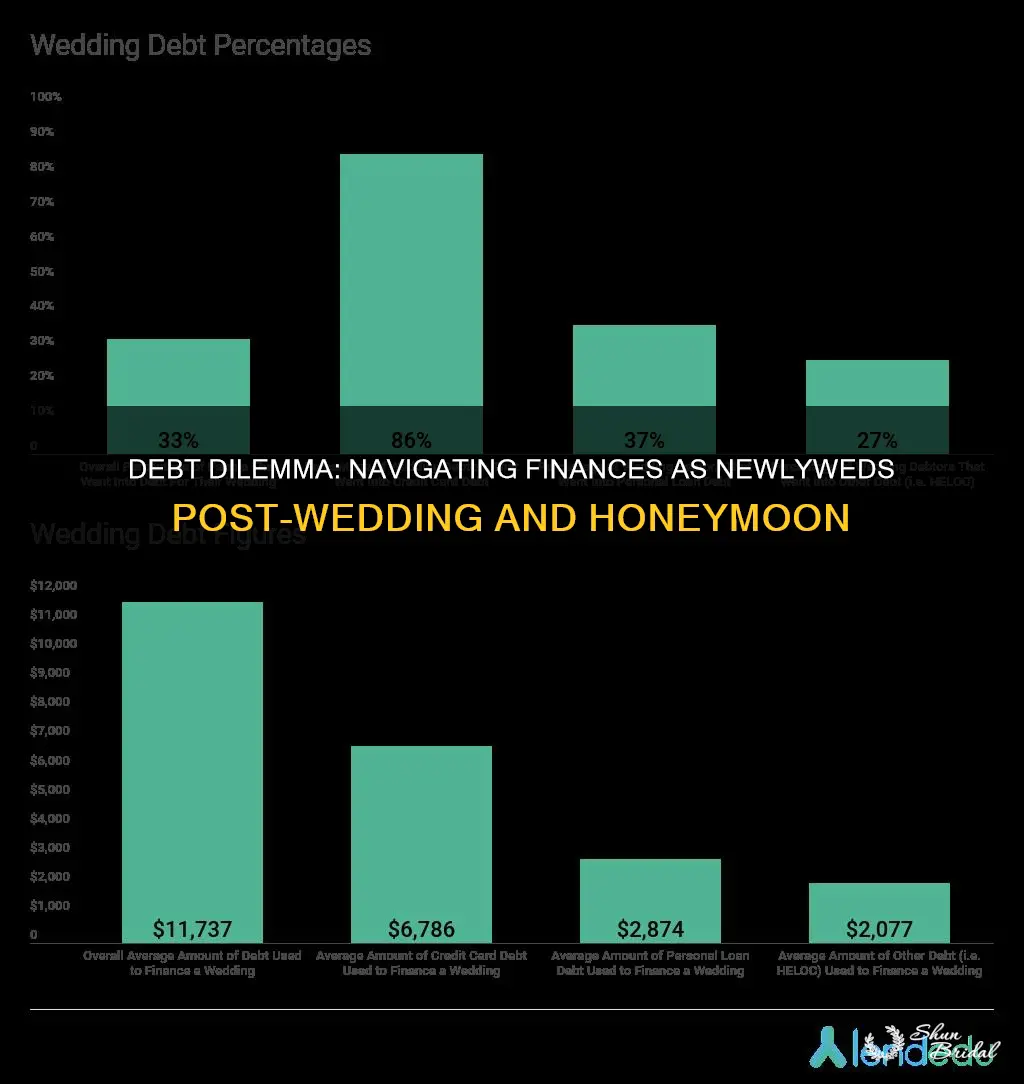

Newlyweds often embark on a journey of marriage filled with excitement and anticipation, but it's essential to acknowledge the financial reality that many couples face post-wedding. The average debt among newlyweds can be a significant burden, impacting their financial well-being and future prospects. Research indicates that the average debt accumulated by couples after their wedding and honeymoon can reach a staggering $25,000. This figure highlights the financial challenges that many newlyweds encounter as they transition into married life.

Several factors contribute to this average debt. Firstly, the cost of weddings itself can be substantial, with expenses ranging from venue rentals to catering, attire, and decorations. These costs can quickly add up, leaving couples with a substantial financial burden. Additionally, the honeymoon, often a cherished part of the wedding celebration, can also contribute to the overall debt. Travel expenses, accommodation, and activities during the honeymoon can further strain the newlywed's finances.

Another significant contributor to the average debt is student loans. Many young adults today carry student loan debt, and marriage can exacerbate this financial obligation. Couples may need to combine their finances, leading to a higher collective debt load. Furthermore, the desire to purchase a home, start a family, or invest in other long-term goals can also result in additional debt.

It is crucial for newlyweds to be aware of these financial challenges and take proactive steps to manage their debt effectively. Creating a comprehensive budget, prioritizing high-interest debt repayment, and seeking professional financial advice can help alleviate the burden. By addressing these financial matters head-on, newlyweds can work towards a more secure and stable financial future.

In summary, the average debt of $25,000 among newlyweds is a significant concern, influenced by wedding expenses, honeymoon costs, student loans, and the pursuit of long-term goals. Recognizing and addressing these financial challenges is essential for newlyweds to build a solid foundation for their financial future.

Honeymoon Fund: Is It a Wedding Tradition?

You may want to see also

Factors Influencing Debt: Wedding expenses, honeymoon costs, and lifestyle choices contribute to varying debt levels

The financial implications of a wedding and honeymoon can significantly impact a newlywed couple's debt levels, and understanding these factors is essential for managing personal finances effectively. Wedding expenses often form a substantial portion of a couple's debt, with costs varying widely depending on personal preferences and cultural traditions. From venue rentals to catering, attire, and entertainment, the list of wedding-related expenses is extensive. For instance, a destination wedding or a lavish celebration can quickly escalate costs, leaving newlyweds with substantial debt.

Honeymoon travel, while often a joyous and memorable experience, can also contribute to a couple's debt. The choice of destination, duration of the trip, and mode of transportation all play a role in determining the financial burden. A luxury honeymoon in a far-flung location or an extended adventure can be financially demanding, especially if the couple incurs additional expenses like excursions and activities.

Lifestyle choices post-wedding significantly influence debt levels. Many couples opt for a lavish lifestyle, which may include high-end housing, expensive vehicles, and frequent dining out. These choices can lead to substantial debt, especially if the couple's income does not match their spending habits. Additionally, the desire to maintain a certain social status or keep up with peers can drive impulsive spending, further exacerbating debt.

Managing debt post-wedding requires careful planning and discipline. Creating a budget that aligns with the couple's income and expenses is crucial. Prioritizing high-interest debt repayment and exploring debt consolidation options can help alleviate the financial burden. It is also essential to differentiate between needs and wants, ensuring that lifestyle choices do not compromise long-term financial stability.

In conclusion, the factors contributing to debt levels among newlyweds are multifaceted. Wedding and honeymoon expenses, coupled with lifestyle choices, can significantly impact financial well-being. By understanding these factors and implementing strategic financial planning, couples can navigate the challenges of debt management and work towards a secure financial future.

The Honeymoon Phase: Exploring the Duration of Love's Bliss

You may want to see also

Debt Management Strategies: Budgeting, financial planning, and seeking professional advice can help manage post-wedding debt

Managing debt after a wedding and honeymoon can be a significant challenge for newlyweds, but implementing effective debt management strategies can help alleviate financial stress and work towards a healthier financial future. Here are some essential strategies to consider:

Budgeting: Creating a detailed budget is the cornerstone of debt management. Start by listing all sources of income and expenses, including the costs associated with the wedding and honeymoon. Categorize expenses into essentials (e.g., rent, utilities) and discretionary spending (e.g., entertainment, dining out). Prioritize paying off high-interest debts first while ensuring essential expenses are covered. Regularly review and adjust your budget as needed to stay on track. Consider using budgeting apps or spreadsheets to simplify the process and make it more accessible.

Financial Planning: Long-term financial planning is crucial to managing debt effectively. Assess your financial goals, both short-term and long-term. This might include saving for a home, starting a family, or investing in retirement. Develop a strategy to allocate funds accordingly, ensuring that debt repayment is a priority. Consider creating a timeline for debt reduction, setting realistic milestones, and regularly monitoring your progress. Financial planning also involves understanding your credit score and report, as a good credit history can help secure better loan terms in the future.

Seeking Professional Advice: Managing debt can be overwhelming, and seeking professional guidance can provide valuable insights and support. Consult a financial advisor or counselor who can offer personalized advice based on your unique financial situation. They can help create a structured plan to tackle debt, negotiate with creditors on your behalf, and provide strategies for improving your financial health. Additionally, consider joining support groups or communities where you can share experiences and learn from others' journeys in managing post-wedding debt.

By implementing these strategies, newlyweds can take control of their financial situation, reduce debt burden, and build a solid foundation for a secure financial future. It is essential to remain disciplined, patient, and proactive in managing finances to ensure long-term success and peace of mind. Remember, seeking help and adopting a comprehensive approach to debt management can make a significant difference in achieving financial stability.

Flintstones' Humor: A Honeymooners' Take on Caveman Life

You may want to see also

Impact on Long-Term Finances: High debt can affect future financial goals, requiring careful planning and discipline

The financial implications of a wedding and honeymoon can often lead to a significant amount of debt for newlyweds, which can have a lasting impact on their long-term financial health. While many couples view these events as milestones and dream vacations, the financial burden can be substantial and may require careful management to avoid long-term consequences.

One of the primary impacts of high debt post-wedding is the potential delay or hindrance of other financial goals. Newlyweds often have aspirations of purchasing a home, starting a family, or investing in their future. However, a substantial amount of debt can make these goals seem unattainable. High-interest credit card debt, in particular, can accumulate quickly, especially if the honeymoon expenses were financed through such means. This type of debt can hinder the ability to save for long-term investments or emergency funds, as a significant portion of the income may go towards servicing the debt.

Careful financial planning is essential to mitigate the effects of wedding-related debt. Creating a comprehensive budget that accounts for both immediate and long-term expenses is crucial. This budget should include not only the wedding and honeymoon costs but also the ongoing financial commitments that arise post-marriage. By allocating funds appropriately, newlyweds can ensure that they are not overspending and that their debt remains manageable. It is also advisable to prioritize paying off high-interest debt first to minimize the overall financial burden.

Discipline and commitment to financial goals are key to overcoming the challenges posed by wedding-related debt. This may involve making lifestyle adjustments, such as reducing discretionary spending or finding ways to increase income. For instance, couples could consider negotiating bills, cutting back on non-essential expenses, or exploring side hustles to boost their financial resources. Additionally, seeking professional financial advice can provide valuable insights into debt management and long-term financial planning.

In summary, while a wedding and honeymoon are joyous occasions, the financial aftermath can be a significant challenge. High debt can impact newlyweds' ability to achieve their long-term financial aspirations, emphasizing the need for proactive planning and discipline. By adopting a strategic approach to managing debt and finances, couples can work towards a secure financial future, ensuring that their wedding-related expenses do not become a long-term burden.

Kate and William's Royal Honeymoon: A Journey of Romance and Adventure

You may want to see also

Cultural and Regional Variations: Debt levels vary by culture and region, with some couples facing unique financial challenges

The financial landscape for newlyweds can vary significantly depending on cultural and regional factors, which often influence debt levels and marriage traditions. In some cultures, the concept of individual financial independence is less emphasized, and couples may enter marriage with pre-existing debts or with a shared financial responsibility. For instance, in certain Asian countries, it is common for couples to live with their parents post-wedding, and the newlyweds might contribute to household expenses, potentially increasing their overall debt. In contrast, Western cultures often promote the idea of financial independence, and newlyweds may face the challenge of paying off student loans or contributing to personal debts before and after the wedding.

Regional economic disparities also play a crucial role in shaping debt levels. In economically prosperous regions, newlyweds might have access to better education and job opportunities, potentially leading to higher earning potential. However, this can also mean they face greater financial expectations and pressures. For example, in urban areas, the cost of living is typically higher, and couples may need to save for a larger down payment on a house or a more substantial wedding. In rural or economically disadvantaged areas, the financial burden might be less intense, but other challenges, such as limited job prospects, could impact their long-term financial stability.

Cultural norms and expectations regarding marriage expenses can also vary widely. In some cultures, the wedding and honeymoon are lavish affairs, often involving significant debt. The pressure to provide an extravagant wedding can lead to couples taking on substantial loans to finance the event. In contrast, other cultures may prioritize practical considerations, and the wedding might be a more modest affair, with less emphasis on debt accumulation. For instance, in some African and Middle Eastern cultures, the focus is on building a strong foundation for the new family, and the wedding expenses are managed within the family's means.

Furthermore, the concept of marriage as a financial partnership can vary across regions. In some cultures, the husband's family might traditionally provide for the bride and her family, reducing the financial burden on the newlyweds. However, this dynamic is changing in many societies, with a growing emphasis on equal financial contributions from both partners. This shift can impact debt levels, as couples may need to manage their finances more collaboratively, ensuring that both parties contribute to and benefit from the marriage equally.

Understanding these cultural and regional variations is essential for newlyweds and financial advisors alike. It highlights the importance of tailoring financial advice and planning to individual circumstances. By recognizing the unique challenges and expectations associated with different cultures and regions, couples can make more informed decisions about debt management, savings, and financial goals, setting them on a path toward a more secure financial future.

Honeymoon Haven: Unveiling Hotels' Special Touches for Romantic Getaways

You may want to see also

Frequently asked questions

It's quite common for couples to take on some form of debt post-nuptial celebrations. The average cost of a wedding in the US can range from $30,000 to $40,000, and many couples also plan a honeymoon, which can vary widely in price. Some may opt for a luxury trip, while others might choose a more budget-friendly option. This financial commitment can be a significant adjustment for newlyweds, especially if they haven't had time to save or plan for these expenses beforehand.

The primary sources of debt often include the wedding venue, catering, decorations, attire, and honeymoon expenses. Many couples also opt for a honeymoon registry or request gifts in lieu of traditional wedding gifts, which can contribute to their overall debt. Additionally, some newlyweds might take out loans for a down payment on a house or other large purchases, believing that their combined income will make repayment manageable.

Managing post-wedding debt is crucial for financial stability. Here are some strategies:

- Create a detailed budget: Break down all expenses and create a realistic budget to understand your financial situation.

- Prioritize high-interest debt: Focus on paying off debts with higher interest rates first to minimize long-term costs.

- Consider debt consolidation: Explore options like personal loans or credit cards with lower interest rates to consolidate multiple debts into one manageable payment.

- Save and invest: Start building an emergency fund and consider long-term investment strategies to secure your financial future.