Getting married is a major life event that can have a significant impact on your taxes. If you're wondering whether you can update your W-4 before your wedding, the answer is yes. While it's not a requirement, it's generally recommended to update your W-4 as soon as possible after getting married to ensure accurate withholding. This is because your marital status can affect the amount of tax you owe, and updating your W-4 will help you avoid overpaying or underpaying your taxes. Additionally, if you change your name after marriage, it's important to report it to the Social Security Administration and update your information with your employer and the IRS.

| Characteristics | Values |

|---|---|

| When to update W-4 | ASAP after the wedding |

| Time limit | None, but within 10 days is recommended |

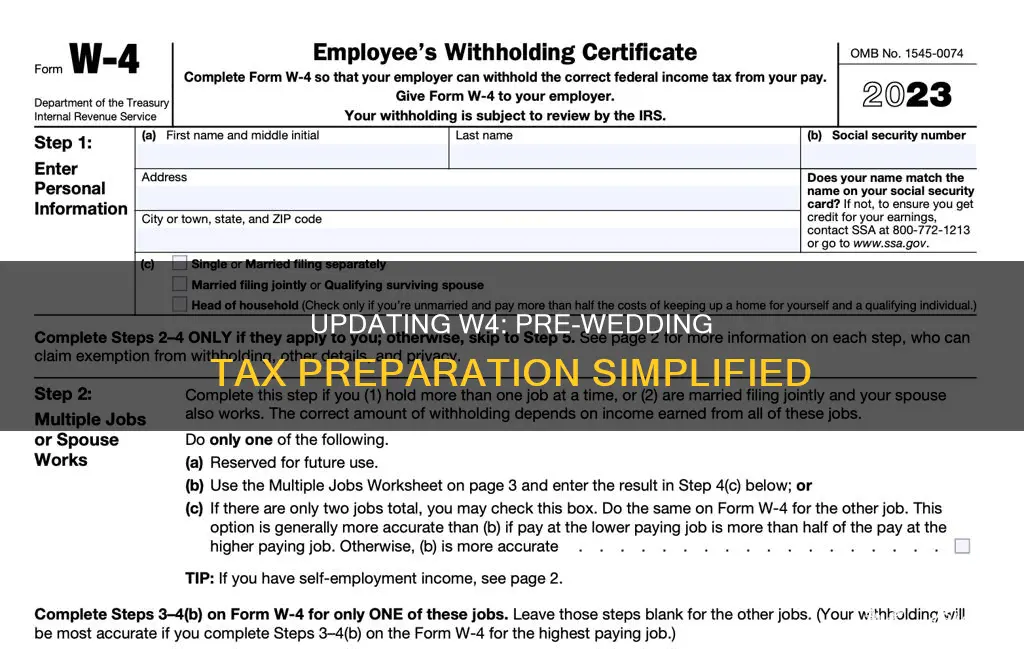

| How to update W-4 | Submit a revised Form W-4 to your employer |

| Impact on taxes | Taxes may be impacted in one of two ways: 1) if your spouse earns an income, your household withholding may need to increase; 2) if your spouse doesn't work, your overall withholding will likely decline |

What You'll Learn

Update your W-4 within 10 days of getting married

Getting married is a major life event that can impact your taxes. If you've recently tied the knot, congratulations! Now, it's time to update your W-4 form within 10 days. Here's a step-by-step guide to help you through the process:

Step 1: Understand the Impact of Marriage on Taxes

Your marital status has a significant impact on the taxes you owe. When you get married, your filing status changes, and you can choose to file your federal income taxes jointly or separately. Most couples benefit from filing jointly, but it's essential to review your situation with your spouse.

Step 2: Update Your Name and Address

If you're changing your name after marriage, report it to the Social Security Administration as soon as possible. Complete Form SS-5, Application for a Social Security Card, and submit it to the SSA. Also, update your address with the IRS and the U.S. Postal Service if you've moved.

Step 3: Update Your W-4 Form

Obtain a new Form W-4, Employee's Withholding Certificate, from the IRS website. Complete the form, considering any changes in your marital status, income, and deductions. Submit the updated form to your employer within 10 days of getting married. This step ensures that the correct amount of taxes is withheld from each paycheck.

Step 4: Review Your Withholding Status

Use the IRS Tax Withholding Estimator or Publication 505, Tax Withholding and Estimated Tax, to review your withholding status. This step will help you determine if you need to adjust the amount of tax withheld from your paychecks.

Step 5: Update Your Bank Account Information

If your bank account is not in your married name, update it to match your new name and the records with the Social Security Administration. This step is crucial, as the IRS will not deposit a tax refund into an account that doesn't match the taxpayer's name.

Step 6: Notify Your Employer

Provide your employer with your updated name, address, and any other relevant personal information. Ensure they have the new Form W-4 and adjust your withholding allowances accordingly.

Remember, while updating your W-4 within 10 days is ideal, you can change it at any time. The key is to ensure that your affairs are in order before filing your tax return to avoid any delays or unexpected tax bills. Congratulations again, and best wishes for a happy and financially organised future together!

Estate Weddings: The Ultimate Guide to Tying the Knot in Style

You may want to see also

Notify your employer of any name changes

If you are changing your name after getting married, you should notify your employer as soon as possible. This is because your name on your tax return must match what is on file with the Social Security Administration (SSA). If it doesn't, it could delay your tax refund.

To update your name with the SSA, you need to complete Form SS-5, Application for a Social Security Card. You can find this form on the SSA website, by calling them, or by visiting a local SSA office.

Once you have updated your name with the SSA, you should contact your employer and ask them to correct any forms that have your former name on them, such as Form W-2 and Form 1099. You can correct the name on the copies of these forms that you use to file your tax return. You should also make sure to update your personal information at work, including your name and address, and look at your W-4 to potentially change your withholding allowances. Your tax situation may be different now that you are married, so you want to ensure the correct amount of taxes is withheld from each paycheck.

If you have not yet changed your name with the SSA, you should file your tax return using your previous name to ensure it matches all the IRS records. You must still use a married filing status, even if you have not formally changed your name.

Freezing a Hawaiian Wedding Cake: Can You Do It?

You may want to see also

Update your address with the IRS and postal service

If you've moved house and changed your address, it's important to notify the IRS and the U.S. Postal Service to ensure you continue to receive any IRS refunds, correspondence, and government checks.

How to update your address with the IRS:

There are several ways to notify the IRS of an address change:

- When filing your tax return: If you change your address before filing your return, enter your new address on your return when you file. When your return is processed, the IRS will update its records. Be sure to also notify your return preparer.

- Notify the post office: If you change your address after filing your return, notify the post office that services your old address. As not all post offices forward government checks, you should also directly notify the IRS.

- Complete Form 8822, Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns): Send this to the address shown on the form.

- Complete Form 8822-B, Change of Address or Responsible Party – Business: This is for changes of address relating to an employment tax return. The IRS issues confirmation notices (Notices 148A and 148B) for the change to both the new and former addresses.

- Send a signed written statement: Include your old and new addresses, Social Security number (SSN), ITIN, or EIN. Mail your signed statement to the address where you filed your last return.

- Notify the IRS by telephone: You will need to verify your identity and the address the IRS has on file for you. Please have your old and new addresses and SSN, ITIN, or EIN ready. The IRS may request additional information to verify your identity.

How to update your address with the U.S. Postal Service:

- Go online: Visit USPS.com to forward your mail.

- Visit your local post office: Notify the postal service in person.

It can take four to six weeks for a change of address request to be fully processed.

Wishes for the Newlyweds: Wedding Card Message Ideas

You may want to see also

Review your withholding status

It's important to review your withholding status, especially after major life events such as marriage, to ensure you're withholding the correct amount of taxes from your paychecks. Getting married can change your tax situation, so you'll want to make sure the right amount of taxes are withheld from each paycheck.

- Fill out a new W-4 form: When you get married, you should submit a new W-4 form to your employer within 10 days. This form tells your employer how much tax to withhold from your paychecks. You can download and print a blank W-4 form from the IRS website or obtain one from your employer.

- Update your personal information: Ensure that your employer has your new name and any new personal information, such as your address. This is especially important if you're changing your name after marriage. You need to report the name change to the Social Security Administration and update your information with the IRS.

- Review your tax filing status: As a married couple, you can choose to file your federal income taxes jointly or separately each year. Most couples benefit from filing jointly, but you should review your specific situation. If you're legally married by December 31, the law considers you married for the entire year for tax purposes.

- Consider tax implications: Getting married may affect your tax bracket, deductions, and credits. You may want to consult a tax professional or use the IRS Tax Withholding Estimator to help you complete your new W-4 form accurately.

- Adjust your withholdings: Depending on your tax situation, you may want to adjust your withholdings to withhold more or less tax from your paychecks. If you want to withhold more tax, you can reduce the number of dependents or add an extra amount to withhold. If you want to withhold less tax, you can increase the number of dependents or reduce the additional withholding amount.

- Review your W-4 annually: It's a good idea to review your W-4 withholdings at least once a year and whenever you experience significant life changes. This will help ensure that your withholdings align with your tax liability and avoid unexpected tax bills or underpayment penalties.

Wedding Expenses: Tax Deductible in Canada?

You may want to see also

Choose a married filing status

Once you're married, you can choose to file your taxes using one of two tax filing statuses: Married Filing Jointly or Married Filing Separately.

Married Filing Jointly (MFJ)

MFJ is the more beneficial option for most people. When you file jointly, you and your spouse will get the married filing jointly standard deduction of $24,800 (plus $1,300 for each spouse who is 65 or older). You are also eligible for more credits, including education credits, earned income credit, child and dependent care credit, and a larger income limit to receive the child tax credit.

Married Filing Separately (MFS)

If you choose to file separately, both spouses must either itemize or take the standard deduction. If one spouse itemizes, the other must do the same, even if the standard deduction would be more beneficial. The standard deduction for married filing separately is $14,600, which is significantly lower than the joint filing amount.

There are certain circumstances where filing separately could be more beneficial. For example, if you or your spouse has a large amount of out-of-pocket medical expenses, filing separately might help you surpass the IRS's threshold to deduct these costs. Additionally, if your student loan repayment plan is based on your income, filing separately may result in lower monthly payments.

How to Choose

To determine which filing status will result in the lowest amount of tax, you can use the "What Is My Filing Status?" tool on the IRS website. This tool can help you understand your options and make the best choice for your situation.

Should the Lord's Supper be Part of a Wedding?

You may want to see also

Frequently asked questions

No, there is no requirement to update your W-4 before getting married. However, it is a good idea to update it as soon as possible after the wedding to ensure accurate withholding and avoid overpaying or underpaying your taxes.

If you don't update your W-4 after getting married, you may end up paying too much or too little in taxes. This can be remedied when you file your tax return, but it is best to update your W-4 as soon as possible to ensure accurate withholding.

To update your W-4 after getting married, you need to submit a revised Form W-4 to your employer. You can use the IRS online Tax Withholding Estimator to help you fill out the form accurately.

In addition to updating your W-4, you may need to update your name and address with the Social Security Administration and the IRS. You will also need to choose a married filing status (either Married Filing Jointly or Married Filing Separately) and review your health insurance coverage.